Saving Account in Bank Of Baroda Account

How to Open a Saving Account in Bank Of Baroda Account 2022

Open Account in Bank Of Baroda Account Account: Banks give a facility to open a savings account as a sole holder or in joint holding with more individuals. Joint accounts may have different modes of holdings such as 'Anyone or Survivor', 'Joint', etc. In case of joint holding, all the applicants must furnish KYC formalities.

In order to open a savings bank account in Bank Of Baroda Account, you need to follow below mentioned steps:

(1) Personally Visit Bank Of Baroda Account Branch

- You need to visit the bank branch in which you want to open your account.

(2) Fill up Account Opening Form (AOF) for Savings Account

- Obtain the Savings Bank Account Opening Form and fill up all the necessary details of the customer's information and other details in the different sections given in the prescribed form like name, address, contact number, email id, PAN, type of account to be opened, nominee's name, etc.

(3) Attach Required (Mandatory) Documents with the Account Opening Form (AOF)

- After completing filling up the account opening form, you need to attach KYC documents like PAN, Proof of Address & Proof of Identity.

Checklist of Required (Mandatory) Documents in case of opening Savings Account

Some banks make it mandatory to provide Permanent address and telephone number.

(4) Verification of Account Opening Form (AOF) & Other Documents by the Banker

- Banker will verify Account Opening Form (AOF) and other attached documents. If he is satisfied with these requirements, he will proceed further.

(5) Deposit Minimum Balance Amount in your Savings Account as per your Savings Account requirement

- After verification of Account Opening Form (AOF) & Other Documents by the Banker, you will be allotted an account number and you will then be required to deposit the minimum required balance in your account as per your savings bank account type.

(6) Obtain Cheque Book, Passbook, Debit Card & Other Documents from the Bank

- Once your account is successfully opened, the banker will hand over Cheque Book, Passbook, Debit Card & Other Documents to you and then you will be allowed to make transactions from your account.

How to Open Savings Bank Account in Bank Of Baroda Account Online?

In order to open a savings bank account in Bank Of Baroda Account online, you need to first check whether your bank gives you an option to open savings account online and if yes, then follow below mentioned steps:

(1) Go Online and Visit Bank's Official Portal

- You need to visit the bank's Official Portal in which you want to open your account.

(2) Fill up Account Opening Form (AOF) for Savings Account

- Initiate the process of account opening through filling up the Savings Bank Account Opening Form. You need to fill up all the necessary details such as customer's information and other details in the different sections given in the prescribed form like name, address, contact number, email id, PAN, type of account to be opened, nominee's name, etc.

(3) Upload Required Documents

- After completing filling up the account opening form, you need to attach KYC documents like PAN, Proof of Address & Proof of Identity.

Checklist of Required (Mandatory) Documents in case of opening Savings Account

(4) Video KYC

- In order to get verified, you can submit your KYC documents through a video call. For this purpose, you are required to provide access to your location, camera and microphone on your smartphone.

(5) Opening of Savings Account

- After getting yourself verified through video call via step 4 mentioned above, your account will be opened and you will be allotted a Customer ID and account number by the bank

(6) Obtain Cheque Book, Passbook, Debit Card & Other Documents from the Bank

- Once your account is successfully opened, the banker will send Cheque Book, Passbook, Debit Card & Other Documents to your communication address and then you will be allowed to make transactions from your account.

Important Points regarding Opening Bank Of Baroda Account Savings Account

- Research and select the bank paying maximum rate of interest under its savings account.

- Different Banks offer different rate of interest under Savings Account.

- Select a nearby bank branch.

- Fill the account opening form in CAPITAL LETTERS using black ink.

- Countersign in case of any overwriting while filling up the account opening form.

- Generally, private banks provide a relationship manager who takes care of any issues or queries related to your account.

- You must avail the nomination facility.

- Don't forget to take the original KYC documents with you for verification purpose.

- Remember that in most of the savings accounts, maintenance of a minimum balance in account is required.

- You may choose one from various Savings Account Types offered by the bank.

- If your mailing address and permanent address are different, provide address proof documents for both.

- Some banks insist upon that the applicant(s) need to come to the branch, in person, for opening the account and will sign at the relevant places in the presence of a Bank Official.

Absa

Titanium Credit Card, How To Apply, Benefits & Requirements 2022

Absa

Secondary Credit Card, Requirements, Benefits & How To Apply 2022

Wells

Fargo Savings Account Requirements 2022

Ecobank

Savings Account Requirements 2022

- You can go to your nearest Bank of Baroda branch and ask the bank officials how to open an account. You are asked to fill out a form.

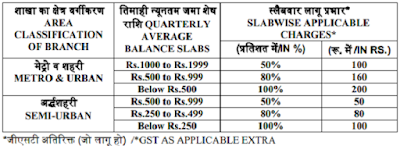

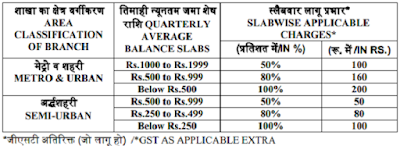

- The minimum quarterly average balance for BoB advantage savings accounts for urban and metro branches will be increased from ₹ 1,000 to ₹ 2,000 from 1 February 2019 and for semi-urban branches, the minimum balance will be ₹ 1,000. Till now, the customer had to maintain ₹ 500 in BoB semi-urban branches.

- Zero Balance Account with overdraft facility in savings bank a/c up to a maximum of 2 months pension amount (net credit to SB a/c last month), if any other credit facility is not being availed by the pensioner.

- Choose how to apply. ...

- Gather your identification. ...

- Provide contact details. ...

- Select a single or joint account. ...

- Accept the terms and conditions. ...

- Choose your deposit amount. ...

- Submit your application.

- I am using Bank of Baroda salary account which is very comfortable . I am using net banking mobile banking it is transaction history can be checked and can be used for money transfer ,it is good to use and very user friendly, everything is good ,customer service is also good and not faced any drawbacks .

- The minimum QAB for Advantage Savings Account for urban and metro branches is being increased from Rs 1,000 to Rs 2,000 and for semi-urban branches, the minimum QAB is being increased from Rs 500 to Rs 1,000. Maintaining several bank accounts adds to the cost.

- Basic savings account is a zero balance account where you are not penalized for not maintaining a specified account balance, like the regular savings accounts.