Transfer Bank Of Baroda Account Saving Account

How to Transfer Bank Of Baroda Account Saving Account from One Branch to Another Branch

How to Transfer Bank Of Baroda Account Saving Account from One Branch to Another Branch: While opening an account with a bank, we try to open it in a branch which is nearby and is easily reachable. In case, you are relocating yourself and your family to a different place or city, you would definitely like to transfer your existing account to a branch which would be near to your new location.

Transferring an account to another branch is needed because many times we need to visit our branch personally and in today's busy life; it is very difficult to visit a branch which is very far from your location.

When it comes to transfer the account from one branch to another, you would like to know how to transfer the bank account from one branch to another branch? It is very easy process which doesn't take more than 10 minutes of yours hence no need to worry about it.

Steps to transfer the Bank Of Baroda Account saving account from one branch to another branch

You need to follow these steps for the purpose of transfer of your Savings account from one branch to another branch:

(1) Personally Visit your Home Branch

- You are first required to go to your branch personally where your existing account is. There you would give a request for account transfer.

(2) Give a written request to Transfer your Savings Account

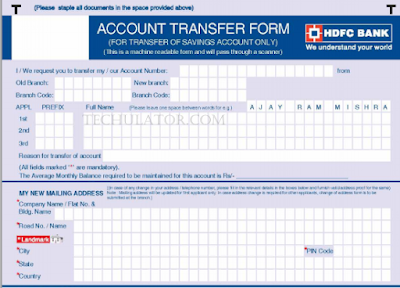

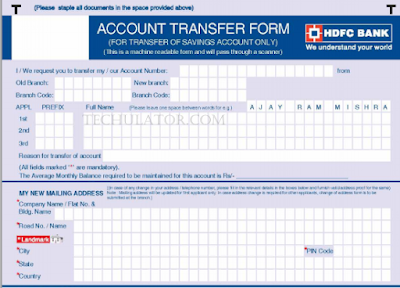

- You are now required to submit a written application for transferring your Savings account to another branch. You need to mention the name of the branch properly and with due care, where you want to transfer your existing account. Some banks also require the reason for such transfer.

(3) Submission of your KYC Documents

- You have to submit KYC documents, in case your bank asks for them, which include copies of PAN Cad, Identity Proof and Address Proof.

- The banker will verify all the documents and if everything is complete, it will initiate for transferring your account to the new branch. It usually takes 2 to 3 days' time.

(4) Visit your New Branch

- After getting the transfer confirmed from your old branch, you may visit to your new branch for confirmation purpose.

(5) Get your new IFSC code from your New Branch

- After getting the transfer confirmed from your new branch, get your new IFSC code and update that code wherever required.

Important Points regarding Transferring of Bank Of Baroda Account Saving Account

- Some banks, now-a-days, also provide facility to change your bank branch online.

- Your account number, customer id and other details will remain same even after transferring your account to another branch.

- Get your new address updated in your bank passbook through your new branch, if your address is also changed, by submitting new address proof.

- Get your IFSC code also updated, wherever required, as different branch generally has different IFSC.

Absa

Titanium Credit Card, How To Apply, Benefits & Requirements 2022

Absa

Secondary Credit Card, Requirements, Benefits & How To Apply 2022

Wells

Fargo Savings Account Requirements 2022

Ecobank

Savings Account Requirements 2022

- After login, click and open Services section and open Account Transfer option under the utility section. Next screen select your account number and click on proceed. Now you need to select your new branch. Select state, city, and your new branch.

- Log in to OnlineSBI by entering your username and password. ...

- Then click on the 'e-services' option and select the 'Transfer of Savings Account' option. ...

- Select the account you wish to transfer and you have to provide the code of the new branch.

- Then you will get the branch name.

- A duly filled up Account Opening Form (AOF) Copy of PAN Card/ Form 60 (with reasons of not having PAN Card) KYC (Know Your Customer) Form with Documents : Proof of Identity & Proof of Address. Proof of Date of Birth (DOB) in case of Minor & Senior Citizen.

- Now, you can get your bank account transferred to a nearby branch in the new city while retaining your account number. The Reserve Bank of India (RBI) has asked banks to allow portability of accounts among their branches if the customer has fulfilled complete KYC (know your customer) details.

- On the mobile app, select Menu option “Fund Transfer”.

- Click on “Other Bank” and opt for “Beneficiary Registration”.

- Select “Online Fund transfer (IMPS)”.

- You need to enter the Payee's MMID and Mobile Number.

- Enter a nickname for the beneficiary.

- There will be no change in your account number. You can continue to use your existing cheque book, debit card, etc.

- Log into your bank's website or connect via the bank's app.

- Click on the transfer feature and choose transfer to another bank.

- Enter the routing and account numbers for the account at the other bank.

- Make the transfer.

- Transfer SBI Bank Account Offline mode/ branch

- Write an application that includes the account name, number, and branch code of the bank where you want the account transferred.

- Carefully mention the date and sign it.

- Request the bank official that the CIF number be transferred along with the account number.

- IFSC code: Each bank branch has its unique IFSC code. This alpha-numeric code is used as an identifier for a transaction, along with an account number. While an individual's account number does not change when bank branches are merged, IFSC codes of the merged branch ceases to exist after some time.